11

October

China: strong growth in exports in 2022/2023

Export volumes rose by 36% between the last two marketing years

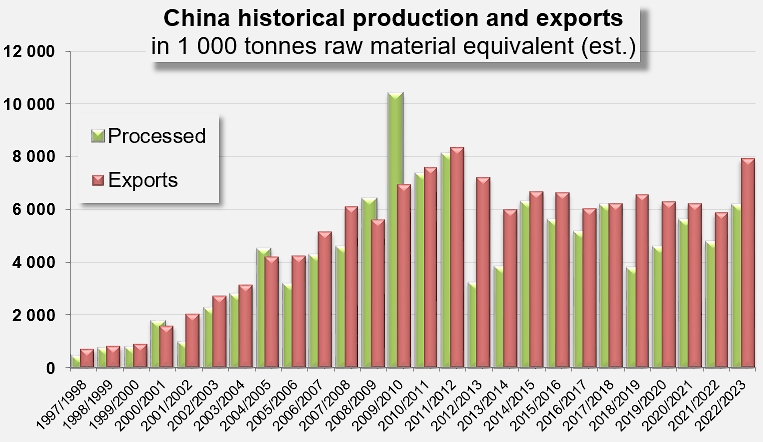

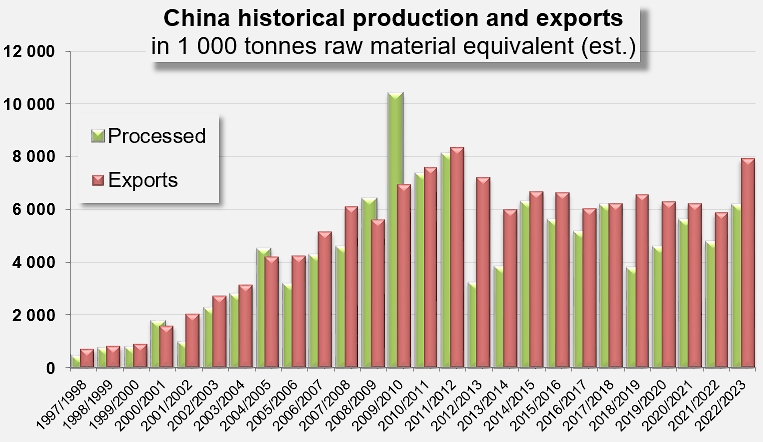

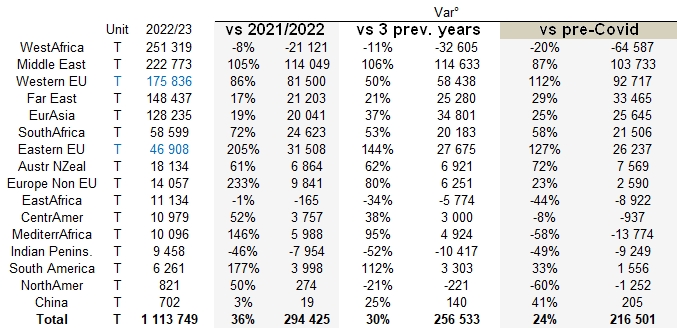

Official figures released by China Customs show a spectacular rise in exports of processed tomato products under HS codes 200290, reaching 1.114 million metric tonnes (t) in 2022/2023. This level of activity, the second-highest after the all-time record set in 2011/2012 (1.169 million t of finished products), follows on from the significant increase in tomato quantities processed during the 2022 season, which had been recorded at 6.2 million t.

For the record, export volumes rose by 36% between the last two marketing years, while processed quantities increased by 29%. Given the average level of Chinese export activity in recent years, and its generally downward trend, the year just ended also saw impressive increases of around 30% on the average level of the previous three years (857,000 t), and 24% on the pre-Covid level (897,000 t).

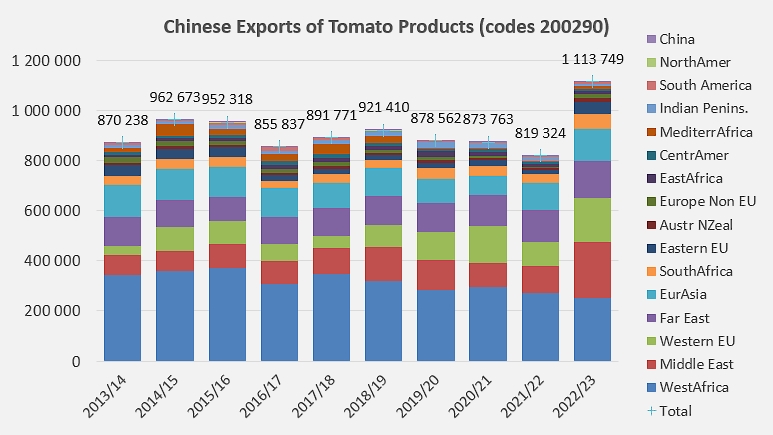

Among the seventeen regions importing Chinese products, the main buyers almost all increased their purchases last year, with the sole exception of West Africa, which is usually a major outlet for China's production. Nigeria, Ghana, Togo, Benin, Mauritania, Cameroon and Côte d'Ivoire accounted for the largest decreases in terms of tonnage, with last year's results confirming the downward pattern recorded over the previous three years and compared with pre-Covid import levels. Purchases by the main customer region for Chinese products were therefore 21,000 t (-8%) lower in 2022/2023 than in 2021/2022, almost 33,000 t (-11%) lower than the average for the previous three years, and almost 65,000 t (-20%) lower than during the pre-Covid period.

Other regions have also recorded lower import quantities in 2022/2023 than in the three years preceding the health crisis. These regions, which accounted for around 5% of Chinese outlets over the last three years, are East Africa (Sudan), Central America (Panama), Mediterranean Africa (Algeria) and the Indian Peninsula (India).

The drivers of the surge in Chinese foreign sales are therefore to be found in other regions. To consider only the increases made in relation to the period (2017/2018-2019/2020) that preceded the Covid health crisis (see additional information at the end of this article), the Middle East and Western EU countries clearly bore the brunt of the development of Chinese sales last year. The explosion in sales to Iraq (usually supplied by Turkey and/or Iran) on the one hand, and the rise of exports to Italy, Spain, Germany and above all Portugal on the other, together account for almost all of the 216,500 t progression in Chinese exports in 2022/2023.

Purchases from the Philippines and Thailand, as well as from Russia, South Africa, Poland and Australia, to name but a few, also contributed to this growth. Conversely, the Emirates, Japan, Gambia, Guinea, Lebanon and Haiti, along with the countries already mentioned, are among those that significantly reduced their purchases of Chinese products last year.

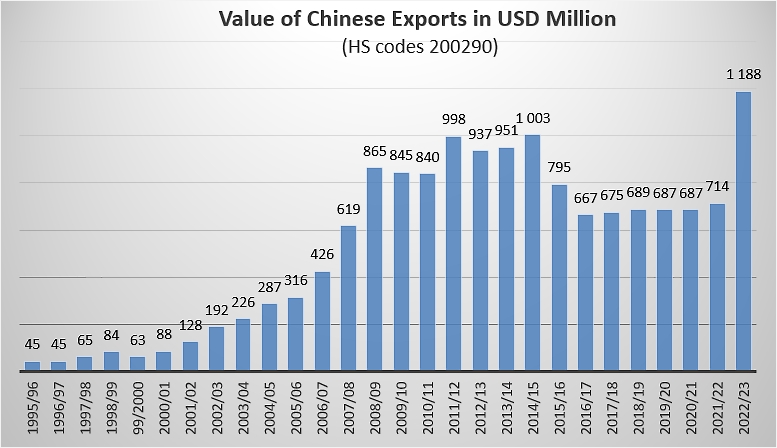

In 2022/2023, the value of Chinese exports under 200290 codes amounted to USD 1.18 billion, i.e. USD 504 million (+74%) more than the average for the pre-Covid period.

These results confirm those of the World Trade Study, which will be published in the TomatoNews 2022/2023 Yearbook, distributed free of charge to participants at the Tomato News Conference organized as part of CibusTec 2023 (Parma, Italy, October 24-27, 2023).

Previous editions of the TomatoNews Processed Tomato Yearbook are available here.

Some complementary data

Chinese exports under codes 200290, by region, in 2022/2023 and comparisons (quantities and percentages) with the usual reference periods.

Evolution of the value in millions of US dollars of Chinese exports under HS200290 codes.

Source: Trade Data Monitor